Volvo CE has released its Q3 2024 financial results: lower volumes in Europe and North America for this quarter, compared to the very high levels of last year, have caused a drop in Volvo CE’s overall net sales. However, the company has maintained overall good margins despite this slower demand and has overseen growth in the China market.

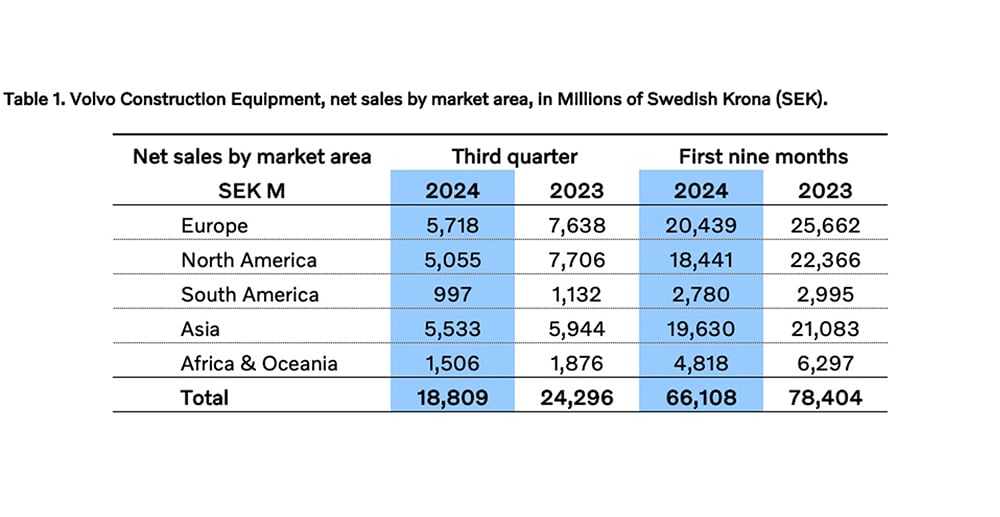

In Q3 2024, net sales decreased by 23% to SEK 18,809 M, compared to the high earnings of SEK 24,296 M for the same quarter last year. When adjusted for currency movements net sales decreased by 20%, of which net sales of machines fell by 24%, while service sales increased by 2%, once more reflecting the market’s growing interest in digital solutions.

However, net order intake has risen slightly, caused largely by a 59% increase in South America and a 44% increase in Europe, strengthened also by a more modest rise in all other regions except North America. Global deliveries were down from last year due to the continued lower market demand and reduction of inventories at the dealerships in Europe and North America, partly offset by increased deliveries for the SDLG brand in China.

Leading the transformation

“We are living in turbulent times and, like other companies, are feeling the effects of a market slowdown. But we are maintaining our leading position with a strong portfolio, the continued roll-out of new products and services and our steadfast commitment to the industry transformation. The ambitions we have set out towards building the world we want to live in remain unchanged and we take pride in working together to balance the priorities of today with our confident vision for tomorrow.”

said Melker Jernberg, Head of Volvo CE.

Volvo CE continued the market launch of new and upgraded models of its most important products and services in key markets in Asia and North America. This included an updated range of the new generation excavator portfolio, as well as the highly anticipated L120 Electric wheel loader.

The quarter also saw the inauguration of a new wheel loader facility in Arvika, Sweden, designed to support the production of electric wheel loaders. This is one of multiple global investments made to drive industry transformation across production facilities and markets worldwide.

Market development

Compared to 2023, the total machine market contracted in Q3, largely due to a slowdown in Europe – a 23% drop from the historically high levels of last year, driven by a combination of low business confidence and a saturated end market. As a consequence of normalizing replenishment of dealer fleets and somewhat lower-end customer demand, North America also came down 9% from very high levels in 2023.

Meanwhile, Asia excluding China was slightly down overall by just 2%, despite market growth in India, Indonesia and the Middle East, while markets such as Turkey experienced declines partly driven by revised government infrastructure investments.

In contrast, the Chinese market grew 5% on the back of governmental policies to stimulate the real estate market, while good demand in Brazil, Peru and Chile saw a similar 5% increase in market development for South America.

Copyright 2020 All rights reserved.

Copyright 2020 All rights reserved.