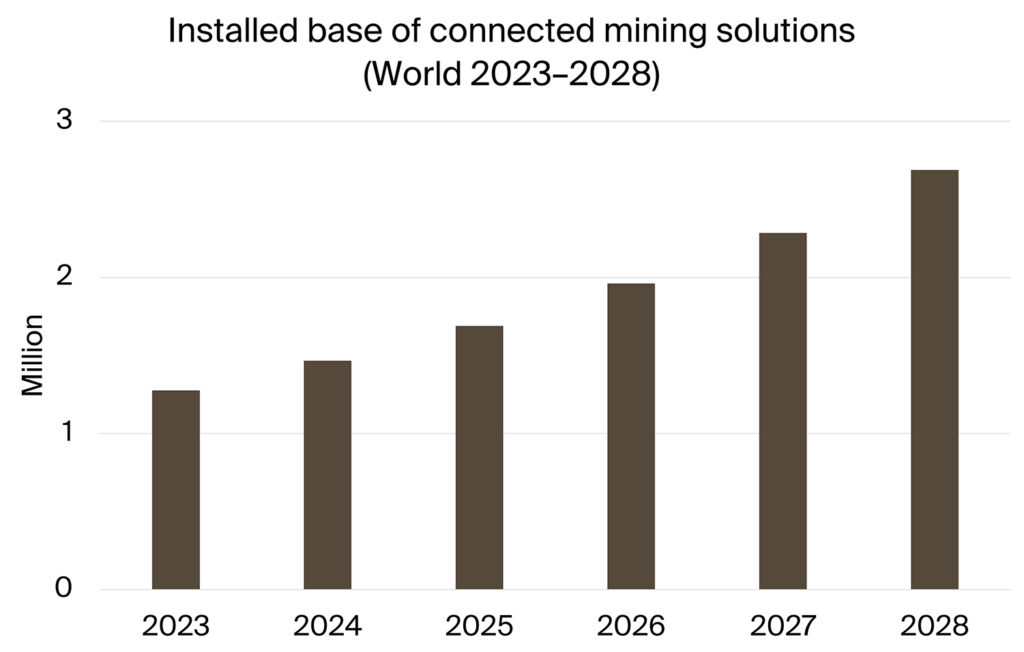

According to a new research report from IoT market research provider Berg Insight, the total active installed base of connected mining solutions reached close to 1.3 million units in the equipment, people and environment segments in 2023. Growing at a compound annual growth rate (CAGR) of 16.1%, the total installed base of connected mining solutions in all these segments is forecasted to reach 2.7 million units in 2028.

The equipment segment accounts for the largest share of the total, representing connected units deployed on machines and vehicles used in mining operations. This includes solutions ranging from OEM telematics systems on mining equipment to advanced connected solutions supplied by mining technology specialists. The people segment includes various solutions deployed to support the safety and productivity of mining personnel, while the environment segment consists of sensor technology implemented for environmental monitoring of the mine itself.

The top players active in the connected mining space include strikingly different types of companies, ranging from specialized independent technology suppliers of varying sizes to leading mining equipment manufacturers. Equipment manufacturers such as Epiroc, Sandvik, Komatsu and Hitachi Construction Machinery have expanded their mining technology offerings largely due to high M&A activity in recent years. Many of the key players today serve both surface and underground mining customers. The surface segment is dominated by Komatsu-owned Modular Mining Systems, Hexagon Mining, Wenco International Mining Systems (owned by Hitachi Construction Machinery) and Caterpillar through its Cat MineStar suite. Modular, Hexagon and Caterpillar all serve underground customers in addition to a primary presence in the surface segment, while Wenco is fully focused on surface mining. The underground mining segment is in general less mature and more fragmented. Examples of key technology providers focused specifically on underground applications are Newtrax Technologies (owned by Sandvik), Mining TAG (owned by Epiroc), Mine Site Technologies (owned by Komatsu), Roobuck and Strata Worldwide.

“Given the operational efficiencies that can be realized, it comes as no surprise that the mining sector has been leading the way for the development of fully autonomous solutions.”

said Veronika Barta, IoT Analyst at Berg Insight.

In the case of underground mining, autonomous mining technology can be particularly beneficial. In addition to the typical advantages that can be realized in surface mine sites such as safety, productivity, equipment utilization and machine health benefits, the need to evacuate areas and suspend operations to allow for ventilation in underground mines can also be reduced. Today, the race between the OEMs to accomplish the highest number of autonomous mining activities is intensifying. The frontrunners, Komatsu and Caterpillar, now have more than 600 autonomous mining trucks in operation each. While a major share of the autonomy-related mining initiatives so far is focused on autonomous haulage systems (AHS), a wide range of other operational activities in the sector can also be automated. These comprise for example drilling and to a smaller extent blasting and dozing.

These insights are based on a report on The Connected Mining Solutions Market by Berg Insight.

Copyright 2020 All rights reserved.

Copyright 2020 All rights reserved.