According to IDTechEx’s latest report, “Electric Vehicles in Mining 2024-2044: Technologies, Players, and Forecasts“, electric haul trucks are on the cusp of significant growth, predicted to be a US$15 billion industry by 2044. The report explores the facets that draw key stakeholders into the space, why electric haul trucks are expected to be a success, and what is still needed as part of the electric transition.

Electric haul trucks will be key to achieving meaningful emissions reduction in the mining industry and assisting mining companies to meet their sustainability objectives. Haul trucks make up almost a quarter of the global mining vehicle population but are by far the largest and most emitting vehicles, contributing to over 90% of vehicular emissions in mining or over 174 megatonnes of CO2 annually. Electrification of these vehicles is steadily progressing at a rate that is drawing the attention of key players across the industry, including mining companies, OEMs, and battery suppliers.

Compared to other mining vehicles, and especially to on-highway vehicle segments, haul truck electrification is still in its nascent stages. Only one or two electric haul trucks have been made per year, and only in 2023 did the total number of these vehicles tip into the double digits. The majority of these have been prototypes and testing models developed by the mining companies themselves and independent retrofitters instead of OEMs. They repurpose existing diesel machines to install batteries or fuel cells for zero-emission operation. First Mode and WAE have been the two most active players in this area and are expanding their retrofitting capacities in the near term.

More recently, major mining OEMs have moved into the electric haul truck space, seeking to develop and commercialize electric models of their existing vehicles in-house. This includes the two largest mining OEMs globally, Caterpillar and Komatsu. Caterpillar has built the 793 Electric prototype, currently in testing and with aims for commercialization by 2027. Komatsu is at a similar stage of development with its 830E electric, aiming for production pre-2030.

What can electric haul trucks offer?

The ramp-up in interest from OEMs in electric haul trucks can be attributed to the rising demand from mining companies. Many of the world’s largest miners have signed agreements with retrofitters and now OEMs for the supply of EV haul trucks when the technology is commercially available. These companies are increasingly realizing that not only are electric haul trucks greener and provide safer working conditions, but they can also generate huge savings in total cost of ownership.

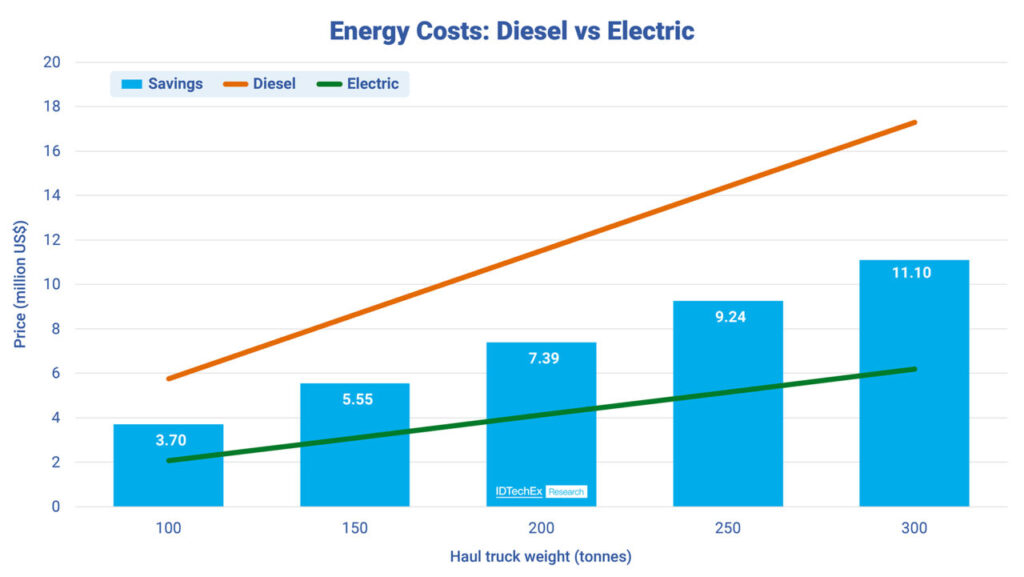

The biggest chunk of the total cost of ownership savings comes from replacing diesel with much cheaper electricity. Haul trucks have the most intensive duty cycles of any vehicle in a mine, working 20-hour days on average and consuming massive amounts of diesel in the process. Any cost reductions will, therefore, compound greatly through the truck’s 10-year lifetime. A single 150-tonne haul truck can save over US$5.5 million in energy costs alone. This is widely applicable across all vehicle weights, with heavier trucks providing even greater upside, highlighting the potential savings that can be generated when an entire fleet of haul trucks is electrified.

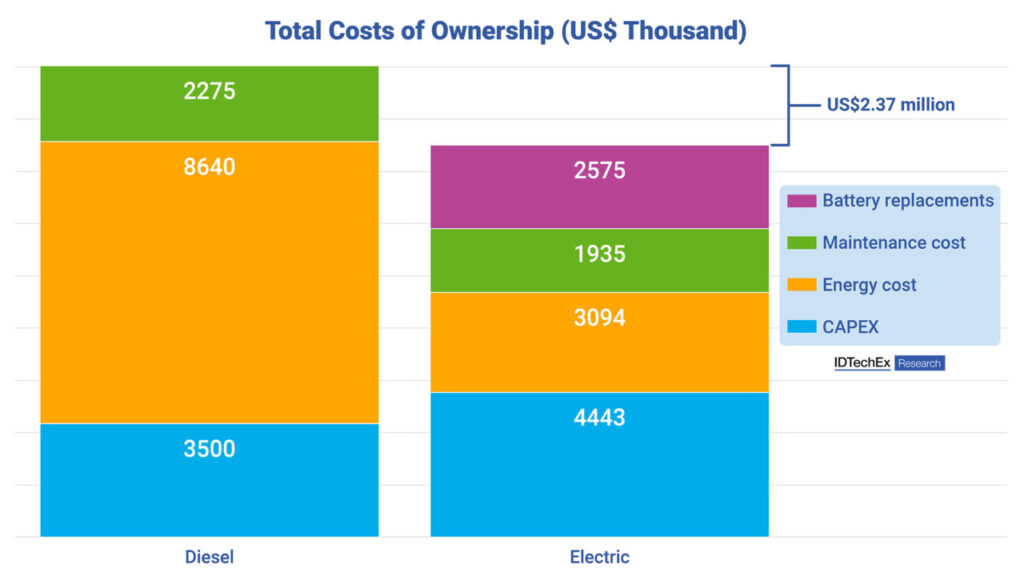

Regardless of the costs that can be saved, electric haul trucks will come at a premium. Haul truck batteries are large and expensive and will need multiple replacements within a 10-year window. The question remains: will energy savings be sufficient to overturn the premiums paid for batteries?

The large batteries needed for electric haul trucks have perhaps been the largest technological and financial bottlenecks inhibiting their adoption, but they are now sufficiently developed and competitively priced for wider use. These batteries regularly exceed 1 MWh, with the largest ones approaching 2 MWh. IDTechEx has collated a database of all existing EV haul truck models, showing that current vehicle runtimes remain under 6 hours on a single charge. For a 150-tonne haul truck to operate for this duration, it will require a battery pack of over 1700 kWh and cost over US$500 thousand.

Energy savings will comfortably exceed the added cost of a single battery. However, IDTechEx expects electric haul trucks will need an additional five battery replacements per vehicle on average, costing an extra US$2.6 million.

More cost factors also play into the total cost of ownership of electric haul trucks. On average, a 150-tonne truck will be able to save around US$340 thousand in maintenance costs in its lifetime. However, an electric driveline is needed for US$70 thousand, plus the labor of retrofitting which IDTechEx estimates at US$360 thousand. While these are relevant and substantial costs, they pale in comparison to the amounts spent on diesel or batteries and are not the key determinants in haul truck economics.

Altogether, despite multiple expensive battery replacements, total ownership costs are strongly in favor of electrification. Mining companies will be able to save nearly US$2.5 million per haul truck electrified, and trucks will break even on their added CAPEX in under 3 years. Given that the volumes of electric haul trucks are still so small, there is plenty of room for the cost of batteries to fall below the US$300/kWh estimate by IDTechEx. Simultaneously, the frequency of battery replacements will decrease as cycle life improves. As these happen, the financial advantages of electric haul trucks over diesel ones will become even more significant.

What do EVs still need?

If electric haul trucks are so financially attractive, why are they not yet widespread? First and most importantly, batteries require size and endurance that are in line with the demands of haul truck duty cycles while still maintaining relative affordability. This aspect has only recently been achievable from battery suppliers such as CATL, ABB, and Northvolt, and the industry is now expanding in response. The development of haul truck batteries is in its infancy – a wide range of designs and chemistries are currently being employed to meet performance demands, and there is yet to be an industry-wide consensus.

Productivity is another sticking point in the adoption of electric haul trucks. Currently, it is impossible for an electric truck to match the uptime of diesel. Where a diesel truck only needs 10 minutes a day to refuel, EVs need to be charged multiple times a day for two to three hours in total. Mining companies will not be willing to adopt a technology if it means sacrificing the productivity and output of their operations.

Electric haul trucks can be over 10% more efficient than diesel trucks (through a combination of higher speeds and less maintenance time), which goes some way to minimizing the impact of electrification on productivity. Still, OEMs are looking to eliminate any impact entirely by extending battery runtimes as much as possible and by bringing in faster charging methods.

Charging is an obstacle for electric haul trucks in its own right. To maintain the productivity that mining companies demand, haul trucks need to be charged at rates of 1 to 3C. High charging rates can compromise the cycle life of batteries, which would necessitate more frequent battery replacements. It remains to be seen if a wide array of battery technologies from various suppliers will be able to be consistently charged at such high rates.

This will also come with an incredibly high energy requirement. Charging a 1700 kWh battery at 3C will require a 5 MW+ connection, equal to the output of two off-shore wind turbines. Charging at such rates would demand dedicated power plants and considerable upgrades to local power infrastructure at great expense to mines. Given that premiums for electric haul trucks are still high, mines might not be willing or able to afford the layout for vehicles and infrastructure together. However, IDTechEx expects that through the financial appeal of EV haul trucks and the wider electrification of mining vehicles and operations, mines will increasingly implement this infrastructure.

OEMs are committing to electric haul trucks in their long-term strategic visions and mining companies have shown willingness to adopt them at the soonest opportunity. The total cost of ownership benefits that they provide are too significant to ignore, and the continued development of batteries and chargers will negate many of the questions currently asked of these vehicles. Electric haul trucks are cheaper to operate, more productive, and far more environmentally friendly, making them the clear winner for the future of the mining industry.

Insights based on IDTechEx’s report, Electric Vehicles in Mining 2024-2044: Technologies, Players, and Forecasts.

Copyright 2020 All rights reserved.

Copyright 2020 All rights reserved.