COVID-19 pandemic has turned out to be a major growth determinant in the industrial automation sector.

With the integration of digital infrastructure to monitor and control public health, industrial automation has taken a new shape. This crisis has enhanced the value of IT and digital transformation across different sectors and industries.

In the current situation of restricted movement and reduced workforce, new technologies have been developed to provide end-to-end automation in different sectors such as food processing. Automated systems are hired by the companies to ensure continued supply and manufacturing of products with the least manual interference.

The digital transformation during the COVID-19 pandemic has enhanced dependency on advanced technologies such as Augmented Reality, Virtual Reality, and the Industrial Internet of Things. The unfulfilled financial targets are compelling the organizations to adopt automation and advanced technologies to stay ahead in the market competition. Businesses are utilizing this opportunity by identifying daily operational needs and inculcating automation in it to create a digital infrastructure for the long term.

The Australia Nitric Acid Market is expected to be valued at US$ 725.3 Mn in 2016 and is expected to grow 1.8X by the end of 2024 to be valued at US$ 1.3 Bn. The market is estimated to be pegged at 1,856.0 kilotons by the end of 2016 and is anticipated to increase at a CAGR of 7.8% in terms of volume over the forecast period (2016–2024). In a new report titled “Australia Nitric Acid Market: Industry Analysis and Forecast, 2016–2024”, Persistence Market Research provides in-depth insights into the performance of the nitric acid market in Australia and highlights important factors and trends influencing the market.

Capacity expansion of ammonium nitrate facilities and increasing mining activities are some of the factors expected to drive the growth of the Australia nitric acid market over the forecast period. Increased production of ammonium nitrate owing to increasing demand for ammonium nitrate-based explosives is in turn expected to drive demand for nitric acid during the forecast period.

Demand for ammonium nitrate explosives is highly dependent on mining exploration activities. Increasing mining exploration activities in Australia – especially in Western Australia and Queensland – are expected to boost the production and consumption of nitric acid in the country. However, enhanced efforts toward the development of alternatives for ammonium nitrate-based explosives in the mining industry could restrain the growth of the nitric acid market in Australia during the forecast period.

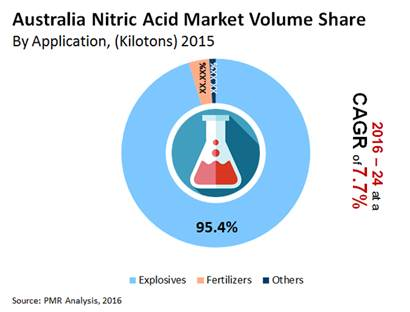

By application, the explosives segment accounted for over 90% volume share in 2015 and is expected to continue to dominate the nitric acid market in Australia, registering a CAGR of 8.0% over the forecast period. In the product type category, the non-fuming segment is likely to account for the largest share of the nitric acid market in Australia and is expected to expand at a CAGR of 8.2% over the forecast period, creating a total incremental opportunity of US$ 580.4 Mn between 2015 and 2024.

The non-fuming product type segment in the Australia nitric acid market was valued at US$ 609.7 Mn in 2015 and is projected to increase to US$ 1.24 Bn by the end of 2024. Application of fuming nitric acid in precious metal refining as well as in litho printing is expected to drive the growth of the fuming segment over the forecast period. The commercial-grade segment accounted for 95.3% share of the nitric acid market in Australia in terms of value in 2015 and is anticipated to register a CAGR of 7.9% during the forecast period. The explosives segment accounted for 95.4% share of the Australia nitric acid market in terms of value in 2015 and is anticipated to register a CAGR of 8.0% over the forecast period.

Queensland and Western Australia are the largest markets for nitric acid in Australia, cumulatively accounting for 58.0% share in 2015. Western Australia, New South Wales, and Queensland are expected to be the most attractive markets for nitric acid in Australia over the forecast period. Consumption of nitric acid in these three regions is expected to reach 1,444.9 kilotons by the end of 2016.

Source: Persistence Market Research

Copyright 2020 All rights reserved.

Copyright 2020 All rights reserved.